Trade disruptions in the Red Sea will negatively impact the chemical and pharmaceutical raw material sector. Since December 2023, persistent attacks by Houthi militants on commercial ships traversing the Red Sea have compelled major shipping companies to reroute their fleets, opting to navigate around Africa via the Cape of Good Hope. According to our Operational Risk team, the rerouting of ships away from the Suez Canal has left Asia-to-Mediterranean trade routes particularly vulnerable, causing significant delays and higher shipping costs. On this note, our Country Risk team anticipates that, due to its significant dependence on consumer goods imported from Asia, Egypt’s consumer market (including pharmaceutical products) will be among the most vulnerable across the Middle East and North Africa (MENA). While the consumer market remains one of the most impacted, supply chain disruptions have also extended into the chemical industry, which is integral for the provision of pharmaceutical raw materials. With China and India being the primary suppliers of these materials to Egypt and the wider MENA region, we predict that Egypt-based drugmakers will face adverse effects due to supply disruptions, potentially hindering their production capabilities and ultimately impacting the stability of Egypt’s pharmaceutical sector.

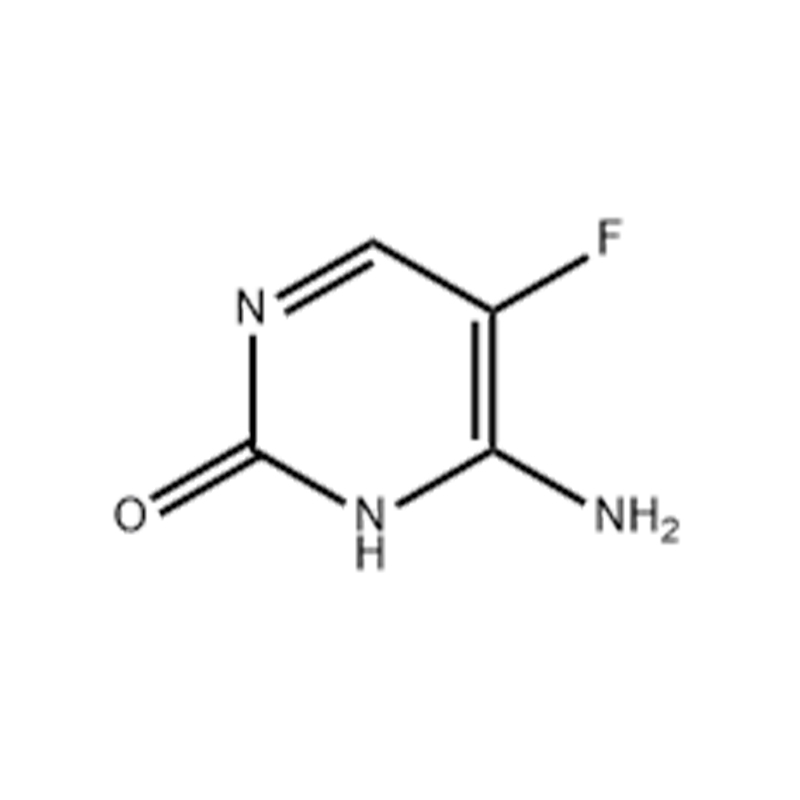

Dwindling pharmaceutical raw material supplies will force Egypt-based drugmakers to operate at lower capacity. Egypt is one of the largest producers of pharmaceuticals in the MENA region, with an estimated pharmaceutical market valued at EGP134.1bn (USD4.5bn). However, despite its extensive domestic manufacturing capacity, Egypt’s pharmaceutical industry remains heavily import-dominated, with around 90% of raw materials sourced from abroad. In 2022, unfinished pharmaceutical products and organic chemicals (including pharmaceutical raw materials) were among the most imported goods from China and India, representing 4.3% and 2.9% of Egypt’s total imports respectively. While the government has initiated preliminary discussions with the private sector to establish domestic factories for pharmaceutical raw materials, these initiatives are still in their early stages and are unlikely to materialise in the near term. As such, we expect Egypt-based drugmakers to remain vulnerable to the trade disruption in the Suez Canal, which would impact access of imported raw materials and the overall availability of pharmaceutical products in Egypt. Posaconazole

The current supply disruption of raw pharmaceutical material is further exacerbated by a weak Egyptian pound and a lack of USD reserves to clear imports of pharmaceutical materials. In H2 2023, over 150 shipments of finished and unfinished pharmaceuticals, worth an estimated USD100 million, have been detained in ports and airports due to the inability to clear these imports, underscoring the severe supply chain challenges facing Egypt's pharmaceutical sector. Domestic drugmakers are struggling to maintain a profit margin, grappling with the high costs of clearing raw material imports and the inability to offset the increased operational costs by raising medicine prices, given the caps enforced by government regulations. As a consequence, companies have been forced to reduce their manufacturing outputs to maintain financial viability. On this note, Jamal El-Leithy, the head of the Pharmaceutical Chamber of the Federation of Egyptian Industries, has noted that domestic factories are operating at only 70% capacity, leading to severe shortages of essential pharmaceutical products, including antibiotics and diabetes medications.

In the near term, Egypt’s pharmaceutical market size will contract in USD terms, before restabilising in the medium term. Supply disruptions, coupled with challenges in clearing imports, have caused the Egyptian pharmaceutical market to currently experience an estimated 30% shortfall in medicine supplies. Ali Auf, head of the Pharmaceutical Division at the Federation of Egyptian Chambers of Commerce, noted that Egypt currently has a strategic stock of medicines equating to to three to 12 months for medicines for which there are alternatives, and three to six months for medicines without substitutes. This has prompted us to revise our pharmaceutical sales forecast.

In 2023, we estimate Egypt's pharmaceutical market to stand at EGP134.4bn (USD4.4bn), experiencing a y-o-y growth of 8.4% in local currency terms but a decrease of 32.4% in USD terms, partly due to unfavorable exchange rates. Throughout 2024, our Country Risk team foresee continued devaluation of the official exchange rate to narrow the gap with the parallel market, positively impacting Egypt’s import-depended pharmaceutical market. As such, we anticipate 2024 to reflect a milder decline in growth in USD terms of -19.3%, as the sector readjusts to the new exchange rates and stabilises in the medium term. By 2028, we forecast pharmaceutical sales to reach EGP212.4bn (USD4.9bn), posting a CAGR of 9.5% in local currency terms and 2.2% in USD terms.

This commentary is published by BMI, a Fitch Solutions company, and is not a comment on Fitch Ratings Credit Ratings. Any comments or data included in the report are solely derived from BMI and independent sources. Fitch Ratings analysts do not share data or information with BMI. Copyright © 2023 Fitch Solutions Group Limited. All rights reserved. 30 North Colonnade, London E14 5GN, UK.

Our analysts and specials guests discuss the key political and geopolitical risks to watch.

Expert analysis of opportunities and risks across emerging and frontier markets.

Our teams are dedicated to connecting you with what you need, quickly, efficiently, and professionally.

Thank you. Your download link will be emailed to you shortly.

Thank you for registering. To read the article please click on the link we have sent to your email address.

Thank you. Your download link will be emailed to you shortly.

Get to know the business behind the products. Meet some of our key people and explore our credentials.

Our latest articles and views on industries, regions, and topics.

Know what you need but not sure where to find it? Discover how we can meet your requirements.

Explore knowledge that cuts through the noise, with award-winning data, research, and tools.

Browse over 2,000 research reports at the Fitch Solutions Store.

Thank you. Your download link will be emailed to you shortly.

Explore knowledge that cuts through the noise, with award-winning data, research, and tools.

Know what you need but can't find it?

BMI has a nearly 40- year track record of supporting investors, risk managers and strategists. We help them identify opportunities and quantify risks in markets where reliable information is hard to find and difficult to interpret. This includes in-depth insight and data, and high frequency geopolitical risk indicators.

CreditSights enables credit market participants to manage financial risk better with independent credit research, global market insights, covenant analysis, and news, distilling market noise into actionable investment ideas.

dv01 provides true transparency in lending markets, and valuable intelligence on every consumer loan in the structured finance world, through a leading data intelligence platform.

Fitch Learning develops the future leaders of the financial services industry and drives collective business performance. We do this by utilizing a best-in-class technology platform and blended learning solutions that maintain the personal element of development.

We help credit, risk, and investment professionals make better-informed decisions and meet regulatory requirements, within and beyond the rated universe. We do this by providing differentiated perspectives and in-depth expertise through Fitch Credit Ratings, Fitch Ratings Credit Research, Fundamental Financial Data, and innovative datasets, all backed by transparent methodologies, accessible analysts, and workflow-enhancing analytical tools.

Sustainable Fitch delivers human-powered sustainability Ratings, Scores & Opinions, as well as Data & Research to serve the needs of fixed income investors. Our specialists uniquely deconstruct the complex issues of E, S, and G globally.

Thank you. Your download link will be emailed to you shortly.

Get to know the company behind the products, our values and our history. Meet some of our key people and explore our credentials.

Explore our latest views on risks and opportunities by industry, region or topic.

Learn more about the BMI products and services that empower you to make critical business decisions with confidence.

Biotechnology Study Know what you need but can't find it?